Understanding the 2025 Social Security COLA Increase

The Social Security Cost-of-Living Adjustment (COLA) is an annual increase in benefits designed to help retirees and beneficiaries keep pace with inflation. The 2025 COLA is particularly noteworthy due to recent economic trends and the potential impact on beneficiaries’ purchasing power.

Factors Influencing the COLA Calculation

The COLA is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measure of inflation for urban households. The COLA is based on the percentage change in the CPI-W from the third quarter of the previous year to the third quarter of the current year.

The formula for calculating the COLA is: (CPI-W in the third quarter of the current year – CPI-W in the third quarter of the previous year) / CPI-W in the third quarter of the previous year.

The CPI-W reflects changes in the prices of goods and services commonly purchased by urban wage earners and clerical workers, including food, housing, transportation, and medical care. Fluctuations in these prices can significantly impact the COLA calculation.

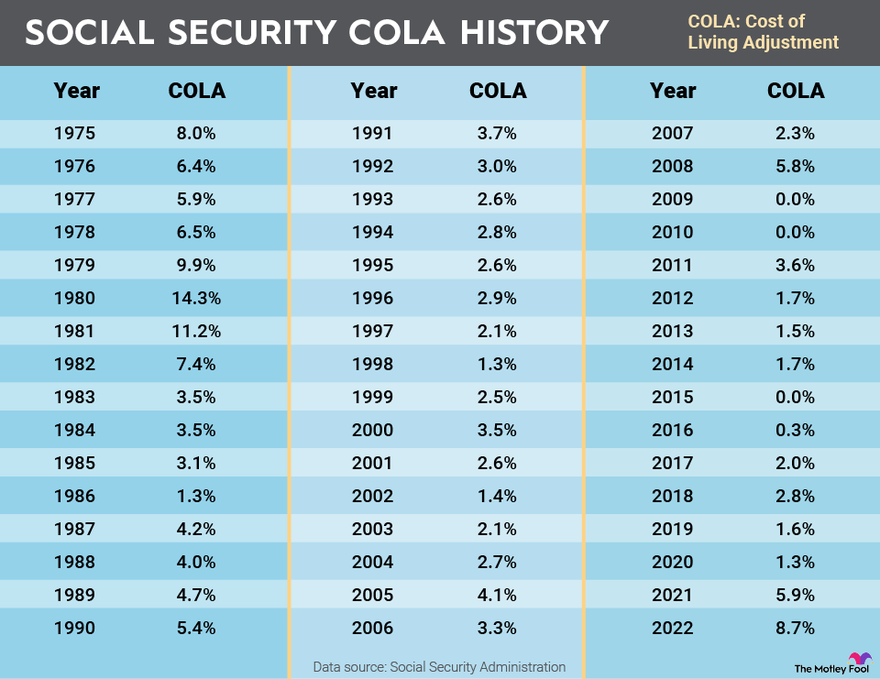

Historical Trends of Social Security COLA Increases

The COLA has fluctuated over the years, reflecting changes in inflation. In recent years, the COLA has been relatively low, with the highest increase in 2022 at 5.9%. However, in 2023, the COLA dropped to 8.7% due to higher inflation.

- The COLA has been below 3% for several years, including 2017, 2018, and 2019.

- The COLA reached its highest point in 1980 at 14.3% due to high inflation during that period.

Projected 2025 COLA Increase and its Potential Impact, 2025 social security cola increase

The projected COLA for 2025 is estimated to be around 3.3%, based on current inflation trends. This estimate is subject to change based on economic conditions and the CPI-W data for the third quarter of 2024.

- A 3.3% COLA increase would mean an average monthly Social Security benefit increase of approximately $50 for beneficiaries.

- While this increase may seem modest, it can significantly impact beneficiaries’ purchasing power, especially those living on a fixed income.

- The impact of the COLA increase on beneficiaries’ financial well-being depends on individual circumstances, such as living expenses, health care costs, and other sources of income.

Implications for Beneficiaries: 2025 Social Security Cola Increase

The 2025 Social Security COLA increase will directly impact the monthly benefits received by millions of Americans. This increase will provide some much-needed relief for those struggling with inflation, but it’s crucial to understand how this adjustment might affect your individual circumstances.

Projected Increase in Monthly Benefits

The projected COLA increase will vary depending on the individual’s current benefit amount. For example, a recipient receiving $1,500 per month could see an increase of approximately $225 per year, while someone receiving $2,500 per month could see an increase of approximately $375 per year.

Impact on Retirement Planning Strategies

The COLA increase can influence retirement planning strategies in various ways.

The increased benefits can help bridge the gap between income and expenses, allowing individuals to maintain their desired standard of living during retirement.

However, it’s important to remember that the COLA increase might not fully offset the effects of inflation.

Impact on the Cost of Living for Social Security Recipients

The COLA increase aims to help Social Security recipients keep pace with the rising cost of living.

However, it’s crucial to note that the COLA is calculated based on the Consumer Price Index (CPI), which might not accurately reflect the specific expenses faced by all beneficiaries.

For instance, while the COLA increase might cover the rising costs of groceries, it might not fully address the increasing expenses related to healthcare or housing.

The Broader Context of Social Security

The 2025 Social Security COLA increase is a reflection of the program’s complex financial landscape and the ongoing debate about its long-term sustainability. Understanding the broader context of Social Security is crucial for grasping the implications of the COLA adjustment and its potential impact on beneficiaries.

The Current Financial Status of the Social Security Trust Fund

The Social Security trust fund is a vital component of the program, designed to ensure the long-term solvency of benefits. It accumulates surplus revenue during periods when more money is collected in payroll taxes than is paid out in benefits. This surplus is invested in U.S. Treasury securities, generating interest income that further bolsters the fund. However, the trust fund is projected to be depleted by 2034, meaning that incoming payroll taxes will only be sufficient to cover 80% of scheduled benefits. This depletion raises concerns about the program’s long-term sustainability and the potential need for adjustments to ensure benefits can be paid in full.

The Long-Term Sustainability of the Social Security Program

The long-term sustainability of Social Security hinges on several key factors, including population demographics, economic growth, and policy decisions. The aging of the U.S. population, with a growing number of retirees and fewer workers paying into the system, poses a significant challenge. Additionally, the program’s reliance on payroll taxes, which are capped at a certain income level, limits its revenue potential as income inequality widens.

Potential Policy Changes That Could Impact Future COLA Increases

Various policy changes could impact future COLA increases, potentially affecting the purchasing power of benefits for recipients. Some of these changes include:

- Raising the retirement age: Increasing the age at which individuals become eligible for full Social Security benefits could reduce the number of years benefits are paid out, potentially easing the strain on the trust fund. This change could also encourage individuals to remain in the workforce longer, contributing to the system.

- Raising the taxable income cap: Expanding the amount of income subject to payroll taxes could generate additional revenue for the program. This approach would require individuals with higher incomes to contribute a greater share towards the sustainability of Social Security.

- Reducing benefits: Lowering the amount of benefits paid to recipients could help extend the life of the trust fund. However, this approach would have a significant impact on the financial well-being of beneficiaries, especially those who rely heavily on Social Security for their income.

- Investing trust fund assets in the stock market: Allowing the Social Security trust fund to invest in a broader range of assets, such as stocks, could potentially generate higher returns, bolstering the fund’s long-term financial stability. However, this approach also carries a higher risk of market volatility and could potentially lead to fluctuations in the value of the trust fund.

2025 social security cola increase – Kok, ado kabar tantang kenaikan tunjangan pensiun tahun 2025? Kayaknya bakalan ada kenaikan lah, tapi belum tau pastinya. Nah, kalau urusan bantu orang kurang mampu, urang ingat samo gwen walz , pancerah hati rakyat Minnesota. Semoga kenaikan tunjangan pensiun tahun 2025 nanti bisa bantu banyak orang, terutama yang sudah tua dan butuh bantuan.

Kabar baik untuk urang tuo nan manantikan kenaikan pensiun tahun 2025! Semoga kenaikan ini bisa membantu meringankan beban hidup. Sambil menunggu kabar pasti, mungkin bisa dicoba coleman deck chair with table untuk menikmati waktu luang di halaman rumah.

Semoga kenaikan pensiun tahun depan bisa membantu urang tuo membeli perlengkapan baru nan nyaman, seperti kursi santai ini, buat bersantai di rumah.